Purchase Price Allocation in an Asset Sale for Tax Purposes

In any deal, the tax implications related to buying and selling a business should be considered when the parties are coming to purchase and sale terms rather than post-closing. Most transactions have material tax concerns that can often surprise buyers and sellers if not assessed early in the process. Often times the taxation of proceeds can erode the economic value attributable to one party or the other. A key aspect is how consideration for the purchase and sale is allocated. Internal Revenue Code Section 1060 requires parties to an asset transaction to identify and allocate consideration to different asset classes, each with specific buy and sell side implications.

Buyers and sellers should consider these implications as the treatment for each party is often in conflict. For example, consideration allocated to a fixed asset will trigger depreciation recapture for the seller (taxed as ordinary income) while the buyer will enjoy higher deductions against its income due to faster expense recognition.

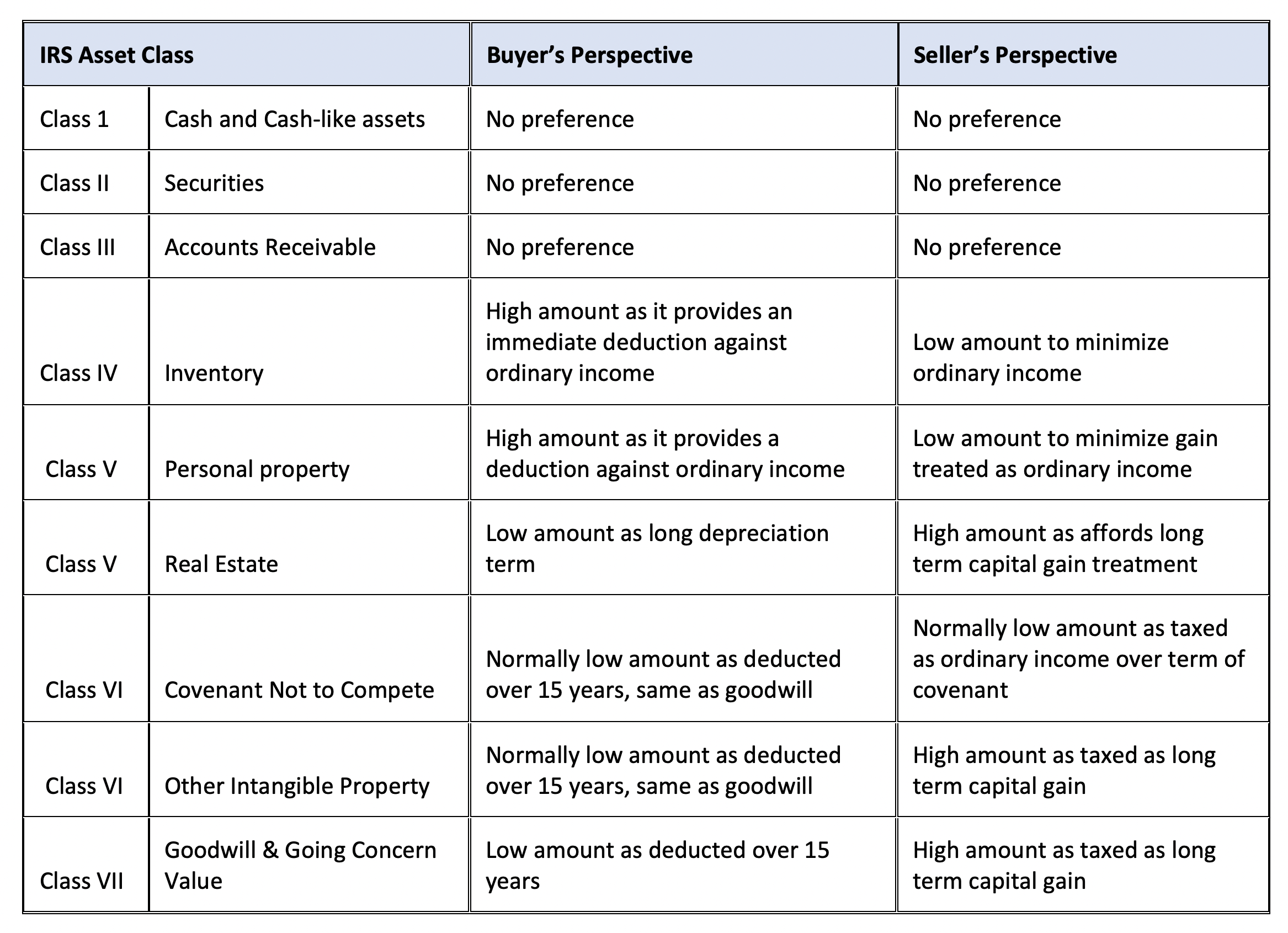

Both the buyer and seller must file Form 8594 along with their respective tax returns for the year in which the transaction occurred. The IRS will review each party’s information for consistency. Therefore, it is important that the parties agree on the allocation to avoid discrepancies and potential IRS examination. Again, negotiation and agreement on asset allocation early in the deal process can avoid contentious post-closing dialog between the parties. The following table shows the asset classes as prescribed by the IRS along with the perspective of buyers and sellers:

It is clear from the table above that the advantages to buyers and sellers are not aligned. The seller’s preference is to have consideration allocated to classes that will be treated as long-term capital gains. The buyer on the other hand will seek to expense asset purchases as quickly as possible that can only be achieved with allocations to inventory and personal property. With the deduction limit increased to $1,050,000 for 2021, buyers have a significant incentive to allocate assets as “Class V”. Another important consideration for personal property allocations for the buyer is sales tax. In some states, the sales tax rates can be very significant and can offset any value of the short-term tax deduction.

The bottom line is that purchase price allocations in asset transactions can create nuances for buyers and sellers that materially impact deal economics. The earlier in the process these matters can be agreed upon, the less contention will exist post-closing. As a buyer, state your intentions clearly in the LOI. Once agreed upon, both parties can define the method of allocation and imbed these provisions into the purchase and sale agreement. Consistent with most aspects of the tax code, application to transactions can be highly complicated. Collaboration of advisors on both sides of a deal can often produce an allocation strategy that is optimal for all parties.

The above is not intended to be nor should be construed to be legal or tax advice. Nothing herein is applicable to any particular situation or set of facts. Readers of this article should engage their own legal or tax advisors regarding the content herein and its impact on any asset sale or other transaction

Recent Comments